GET TO KNOW HEDGEHOG

How it works

Our model is unique, so let’s take it step by step.

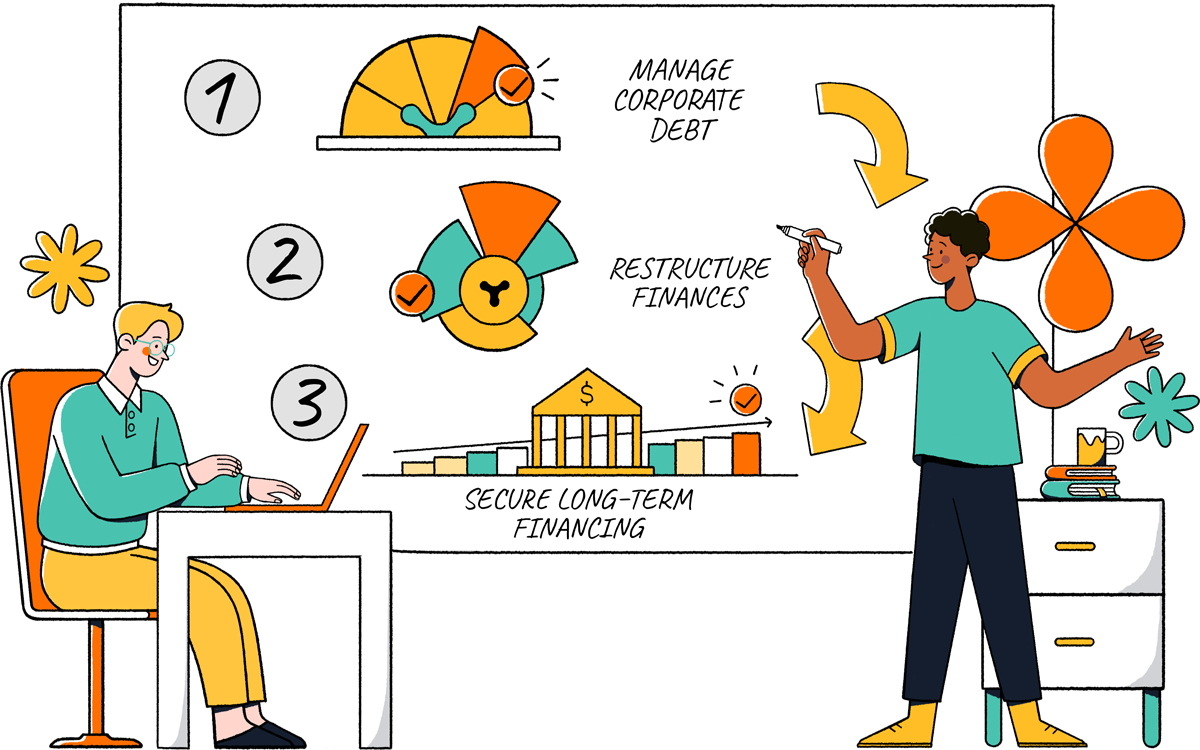

Step 1:

We use 3 processes to protect your capital

Every Hedgehog ‘investor’ is a lender, because the agreement with us is a loan contract.

In order to protect our investor’s capital, we utilize insured trust accounts, implement rigorous vetting processes, and maintain reserves to ensure that every contract is met. Every investor contract to date has been honored to the letter.

Step 2:

We use the funds to support growing businesses

We provide tailored business service offerings to corporations to help them qualify for financing to grow their business.

Hedgehog does not fund or invest in these companies, we provide the necessary services they need to help them qualify for a loan. This process usually takes 4-5 months, after that we no longer have ties to the companies.

Step 3:

You earn 12-20% interest each year

Your investment with Hedgehog offers great returns of 12-20% with a 12-month contractual hold, but one of the best parts is that these returns compound year over year. With high returns and compound interest working together, Hedgehog investors get to maximize overall returns.

Each Hedgehog investor will get a minimum of 12% interest on their 12 month contract. This can scale up to 20% based on how much money they lend, and the best part is that these returns compound year over year. With high returns and compound interest working together, Hedgehog investors get to maximize overall returns.

10 Year Example Investment

What Our Clients Say

“For years we’ve been feeling like we have all this equity in our home, but it isn’t doing us any good. Then Hedgehog Investments came along and our equity is now making us money. We’ve been very impressed with this services and are excited to continue doing business with Hedeghog.”

Why our model works

It's not rocket science, but it's pretty complex! To break it down, successful small and medium size businesses come to us for assistance to get long term financing. They can't get what they need through avenues like SBA and they don't want to give up their company to venture capitalists.

High Demand

The need for our services increases as lending gets harder to obtain, so the demand for our services is at an all-time high

Strategic Investing

Once our services are complete, we recoup all capital and fees out of the financing obtained from the lending institution.

History of Success

Over a decade with an impeccable track record using this model to generate returns. Every investor contract to date has been honored to the letter.