There’s a better way to build wealth

What is an alternative investment?

An alternative investment is a financial asset that doesn’t fall into one of the conventional investment categories like stocks, bonds, or cash.

Common types of alternative investments

Private Equity

Hedge Funds

Real Estate

Tangible Assets

Natural Resources

Private Lending

The benefits of alternative investments:

Lower volatility

Alternative investments don’t rely on market trends the way traditional investments do. The potential risk depends on the strength of the investment model itself.

Portfolio diversification

Because alternative investments don’t directly correlate with the stock market, they can be a great way to diversify your portfolio.

Higher Returns

Alternative investments are designed to use creative strategies and offer a broader range of investment types which allows them to often produce higher returns than their competitors.

Hedgehog’s

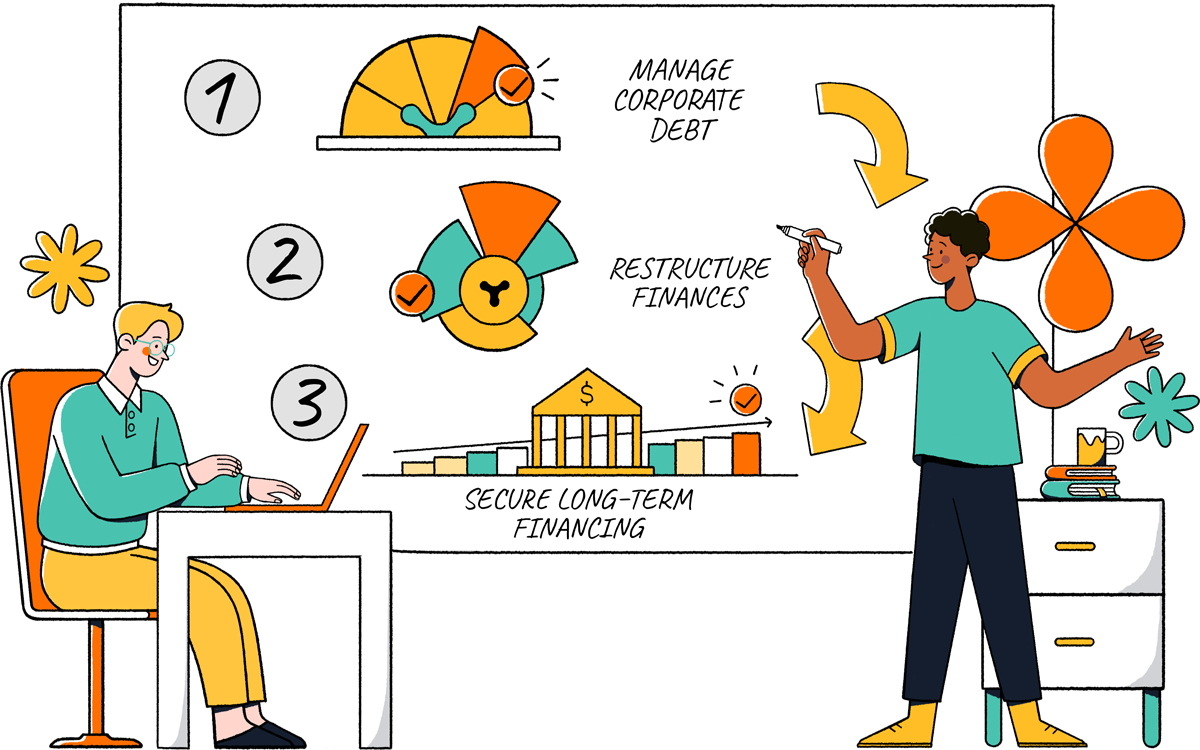

investment model

Our model uses investor funds to help up-and-coming companies qualify for long-term financing. Hedgehog does not invest in these companies, so your investment performance isn’t dependent on their long-term success. The best part? Hedgehog investors earn 12-20% of interest each year.

Why Choose Us

Let’s build better wealth, together.

Hedgehog can help you reach your investment goals whether you want to save for retirement, buy a home, or start a new business.

Get Started